Kristijan Krezić, FOTO: Danica.hr

BANJALUKA – Kristijan Krezić's business journey has been going from Switzerland and Germany through Croatia to Republika Srpska for the past few years. Krezić presents himself as a businessman with countless successful ideas and projects that are little known to the public. He mostly leaves behind debts, dissatisfied clients and partners, some of whom seek him through the courts.

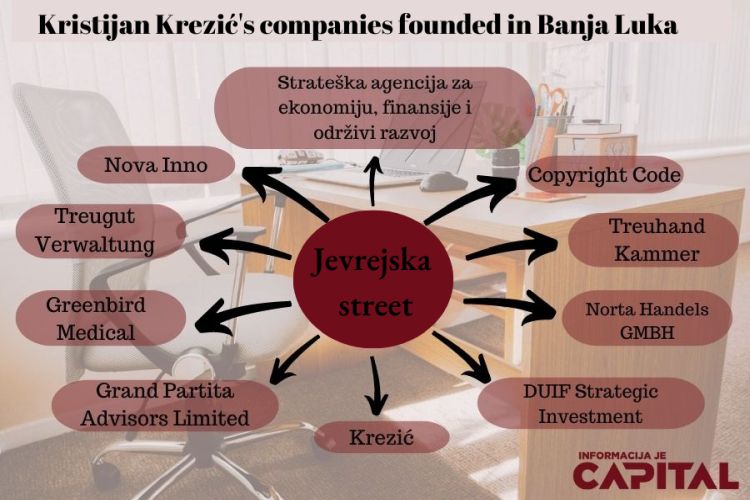

Banja Luka has been his refuge for the last two years. In it, he founded a dozen companies that mostly accumulate liabilities to the state. Despite everything, his high opinion of himself pushes him into new businesses, some of which fail even before they start.

Thus, the Securities Commission (KHoV) of Republika Srpska revoked his “Strategic Investment” investment fund management company's license to operate even before it started any serious business.

Krezić founded this company to manage the “Financial Special Activities Division” fund.

However, like numerous other projects that Krezić started in Srpska in the past two years, this one also failed.

Namely, he failed to collect basic capital for management, and in the meantime, the partners with whom he entered into this story turned their backs on him.

He was given a period of a few days to change the business name and activity of the company, and then to provide the Commission with proof that he did so.

The Commission granted “Strategic Investment” a business license in June of last year when Krezić received a license to acquire a qualified share in the Company.

Krezić, as well as Aleksandar Čolić, received licenses to perform the functions of executive directors, and Krezić, Vladan Zečević and Goran Ćetojević received licenses to perform the functions of members of the Management Board.

At the end of last year, the fulfilment of organizational, personnel and technical requirements of the Company was checked and it was determined that it meets the requirements.

A few days later, the Commission received a request from “Strategic Investment” for a license to establish an open mixed “Financial Special Activities Division” fund, which – as it turned out – would be the beginning of the end of this story.

Namely, on January 31 of this year, the Company informed the commission that their liquidity is threatened, because the amount of the basic capital is lower than prescribed.

We would like to remind you that according to the Law on Investment Funds of the RS, the minimum amount of basic capital of a management company is 250,000 KM.

Also, Goran Ćetojević, a member of the Company's board of directors, informed the Commission during that period that he had irrevocably resigned as a member of the board of directors.

The Commission asked for a statement from the Company, but never received an answer regarding this resignation.

In May of this year, they ordered them to find the money within 15 days and harmonize the amount of the basic capital with the law, but there was no response to that letter either.

“Since the Company did not act in accordance with the decision and order, nor did it inform the Commission of any procedures and actions regarding the execution of the issued order, the Commission determined that the Company does not meet the conditions prescribed by the Law on Investment Funds for performing the activities of establishing and managing investment funds”, it is stated in the decision of the Commission.

After all this, Aleksandar Čolić resigned from the position of executive director, and the Commission confirmed this in its decision of June 17 of this year.

Also, the request to establish a fund was rejected, which was assessed as unfounded, because Krezić, as we have already mentioned, failed to find partners who would invest in this business.

There is no government money

According to the fund's prospectus, which CAPITAL journalists had access to, the entry fee was up to ten times higher than the fund's investment goal, while the exit fee was very discouraging.

Namely, an investor who tries to withdraw funds within a year has to say goodbye to a fifth of the value of the shares if he decides to withdraw them by 2024.

An economist with extensive experience in managing funds, who wished to remain anonymous, analyzed for CAPITAL prospectus. He assessed that this fund would have the most expensive form of management and the most disincentive form of withdrawing funds from the domestic market.

“The cost of managing this fund is the most unincentive on the domestic, but also on the foreign market, bearing in mind the investment goal, achieving a return between 0.22 and 0.45 per cent annually, because the management fee is 12.5 per cent, and if a higher return is achieved from the reference yield, the difference belongs to the fund manager in the amount of 31 per cent. Bearing in mind past experiences, the investment structure does not meet the profitability of investors’ investment in the fund”, he told us.

Informed interlocutors claim that Krezić's goal was for state institutions and companies to invest money in the Fund, regardless of the fact that the conditions are more than disincentive, but the “agreement” with the “top” backfired.

A pile of debts and failed projects

The business with the Fund is just one of many unsuccessful ones that Krezić started in Republika Srpska after similar attempts in Croatia.

In Banja Luka, he founded dozens of companies that mostly accumulated debts to the state and workers who are now, together with inspectors, looking for him everywhere to settle their obligations.

The Tax Administration (PURS) of the Republika Srpska initiated forced collection in his companies “Greenbird Medical”, “Nova Inno” and “Krezić” due to a debt of less than 27,000 KM.

For now, the tax authorities have collected the debt from the third company that bears his last name, while for the remaining two legal entities he still owes more than 12,000 KM.

Closeness to Dodik

Krezić was associated with some of the highest officials in Republika Srpska and was mentioned as one of the closest associates of Milorad Dodik, through whom he had inexplicably great influence in the Government of Srpska.

It was said that he wanted to become the head of the Investment and Development Bank, that he promised to bring billions of investments to Serbia, but also that his fund got a license only after intervention and threats from the highest political level towards the RS Securities Commission.

Also, some of CAPITAL's interlocutors said that both foreign and domestic businessmen were offered mediation with the Government of Republika Srpska.

When registering one of his companies, he tried to use the name of Republika Srpska as a way to present his idea as a state project.

That's how he started to establish a company that he planned to call “Centralna rafinerija zlata Republike Srpske” (translation: “Central Gold Refinery of the Republic of Srpska”).

The District Commercial Court in Banja Luka prevented him from doing so, because such a thing requires permission from the competent authorities.

Earned a number of criminal charges in Germany and Switzerland

What should worry Krezić more than the tax debt, which amounts to several thousand marks, are former partners and investors who claim that he left them with nothing.

Dusseldorf, PHOTO: Pixabay

Several people in Switzerland and Germany have filed criminal charges or started lawsuits against him, accusing him of defrauding millions.

In Switzerland, Krezić had the company “Templar” through which he borrowed money from people with a promised monthly yield or interest of 1.22 per cent, and which he was supposed to invest further.

However, later he would simply stop responding.

At least ten people believe that Krezić cheated and damaged them for a total sum of at least ten million euros, the CAPITAL portal found out by investigating his business.

He also had a company with the same name in Dusseldorf, only this one was engaged in lending gold. This case is also being investigated by the competent prosecutor's offices in Germany, to which dozens of victims have contacted.

Little is known about everything, because the contracts that “Templar” concluded with investors were very strict regarding the “leaking” of any information.

In the event that someone violates the obligation of confidentiality, the contract stipulated a fine of 200,000 francs.

Krezić presented his company to investors as an exclusive club, and on that basis, he charged them an annual membership fee of 250 euros.

He claimed to future members that hundreds of investors were involved in the program, including famous football players, politicians and music stars, and besides money, he accepted real estate, cars, gold and the like as collateral.

Both of his companies are now in the process of liquidation.

Before Srpska, he “developed a business” in Croatia

Before he appeared in Banja Luka, Krezić was presented in Croatia in September 2020 as an investor who, after successful projects in Switzerland, is returning to Croatia to realise himself there.

He also claimed that the banks are enchanted by his ideas, so at any moment they offer him between 500 and 900 million euros of money to invest.

Through the company “Greenbird Medical” he bought land in Koprivnica on which he promised to build a factory where cannabis-based pharmaceutical preparations will be made.

The plan was to hire hundreds of workers and invest millions, but little of that was achieved.

Already in July of the following year, everyone was already wondering where he had disappeared to, and he appeared in Banja Luka with all his ideas, which met with the enthusiasm of the political elite of Srpska.

We were unable to find out what Krezić's plans are and how he comments on criminal charges abroad. We tried to get in touch with him in several ways, but without success. On the website, only the e-mail from which the sent mail is returned is listed as a contact.

CAPITAL