Citizens Losing Homes and Business Spaces as Investors Fail to Repay Loans

Photo: Pixabay

If you buy an apartment or business space in a building for which the investor has not yet repaid the loan, and the land is mortgaged, there is a possibility that you may lose the purchased property regardless of the fact that you have personally paid the full amount.

Written by: Andrijana Pisarević;

To construct residential and commercial buildings, investors in Republika Srpska often take out loans from banks. However, if they fail to repay these loans, their debts can easily transfer to the buyers of apartments and business spaces, even though they have already paid their share to the investor, often also through loans from banks.

To secure loans, investors usually put land under mortgage as collateral, which then “extends” to the building that is yet to be constructed. Buyers of apartments often overlook or do not fully understand this clause when entering into purchase agreements, trusting that the investor will finish the project on time and with a certain level of quality, as promised.

The problem arises when the investor sells the apartment or business space but fails to repay the borrowed funds to the bank and meet the agreed deadlines. Banks then turn to the buyers to recover their claims from their apartments and business spaces.

This happened to the owner of a business space in a building in the suburbs of Banja Luka, who spent a lot of time and money, even reaching the Supreme Court in an attempt to prove that the mortgage does not apply to his property and that the bank should recover the debts from the assets of the investor who has meanwhile gone bankrupt. Ultimately, he was unsuccessful in this endeavour, and his business space ended up being sold.

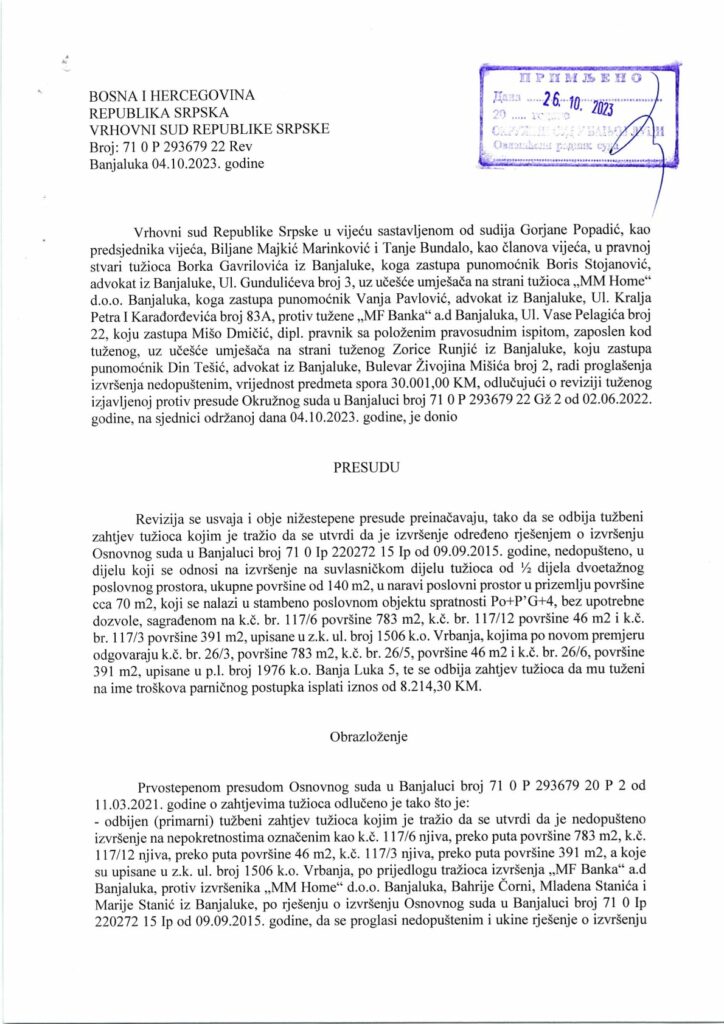

All of this is confirmed by a court ruling from the Supreme Court of Republika Srpska issued at the end of last year, which decided that the mortgage on the land can encompass the constructed residential and commercial units, thus becoming a burden for new owners of apartments and business spaces.

This ruling overturned previous decisions made by the District Court and, before that, by the Basic Court in Banja Luka, which did not allow the bank to enforce its claim on the business space because the investor who built the building had not fully repaid the loan.

Supreme Court Sides with Banks

As stated in the judgment, the first-instance court determined that a loan agreement was concluded between MF Bank and the investor “MM Home” in 2013, after which the investor was paid 170,000 KM. The repayment period was 22 months, with a grace period of 10 months and a fixed interest rate of 11.50 per cent. To ensure loan repayment, among other things, a mortgage was agreed upon the land.

On that land, a mixed-use building was constructed, apartments were sold, and business space on two floors was purchased by Borko Gavrilović. However, due to unresolved paperwork regarding the building itself, he failed to register as the owner of the business space. Later, the same space was put up for sale to settle the debt to the bank because the investor did not repay the loan, and his company went bankrupt.

“Given the legally established unity of immovables, the main element of condominium ownership is no longer, as per the previously applicable law, the apartment, business premises, because the rights from the land extend to what has permanently joined it, including the building, and through the building to its individual functional units, so condominium ownership represents the corresponding co-ownership share of the land permanently associated with a specific part of the building,” the Supreme Court states in the judgment.

It is also stated that Gavrilović paid the agreed amount to the company “MM Home” but did not register as the owner because the purchase contract was concluded while the land of the building was under mortgage. The judgment also states that Gavrilović knew that the property was burdened with a mortgage at the time of signing the contract, which the notary who drafted the contract should have informed him about. He agreed to the purchase under those conditions and is “obliged to endure the execution proposed and determined on the entire immovable property, and thus on the business space belonging to the building, i.e., the land.”

The judgment explains that MF Bank acquired a voluntary mortgage on the properties in Vrbanja based on the loan agreement, and it was recorded as co-ownership with one person in the public register.

“The building is not registered in the land register, the apartments and business spaces are sold and handed over to buyers, the builder did not perform the condominium division of the property. The defendant (MF Bank) filed a motion for enforcement to realize the agreed mortgage. By a decision of the Basic Court in Banja Luka in September 2015, enforcement was ordered on the properties, and in April 2019, the enforcement by sale of the two-story business space was ordered,” the court states.

Investors Shift Responsibility onto Buyers

One of the representatives in this dispute, attorney Din Tešić, whose office specializes in banking, expropriations, and real estate disputes, emphasizes that this is another way in which investors shift their responsibility onto buyers, who do not carefully read contracts and risk losing ownership of paid apartments or business spaces.

Din Tešić/Provided photo

“I notice an increasing number of cases where the investor collects the sale price of apartments and business spaces but does not return the loan funds to the bank, nor does he meet the agreed deadlines and material quality. In such cases, the bank recovers its dues from the apartments, despite their sale price being duly paid to the investor, as the bank has acquired a mortgage even on the apartments that have been constructed. The Supreme Court of Republika Srpska has clearly taken the position that the mortgage registered on the land extends to the building constructed after the mortgage is registered on the land,” says Tešić.

He says that most investors build residential buildings predominantly using loans from commercial banks, which register mortgages on the land parcels before construction starts, securing their claims.

“Buyers of apartments under construction often overlook the fact that the mortgage is not registered on the newly constructed apartment they are purchasing and blindly trust the investors that the building will be completed within the agreed deadlines with satisfactory quality. In this case, our client had an interest in intervening in the lawsuit on the side of ‘MF Bank’ to prove that the bank has the right to recover from the business spaces of the investor that remained in the building, as otherwise, it would have to recover its claim by selling the apartments of conscientious buyers. Our position was adopted by the Supreme Court of Republika Srpska, allowing the recovery of claims from the investor’s business space,” says Tešić.

He particularly emphasizes that in such cases, he does not recommend buying an apartment or business space without consulting a lawyer and notes that notaries are not obligated to advise parties in the process and take a neutral stance between the contracting parties.

Scams as a Phenomenon

A similar situation occurred in the case of Veljko Kuridža from Oštra Luka, who almost 16 years ago paid nearly 20,000 BAM in advance for an apartment in Banja Luka, where he was supposed to move in by 2009. The epilogue of the story known as the “Del Invest” or “Veseli Brijeg” affair is that the building was not constructed, and he, like many other buyers, never got his money back, despite court judgments.

The investor Zoran Delić fled Bosnia and Herzegovina, and later was arrested based on an arrest warrant, extradited, and, based on a plea deal, convicted of tax evasion. Kuridža, along with other aggrieved buyers, reached the Constitutional Court of Republika Srpska, the Constitutional Court of Bosnia and Herzegovina, and the European Court of Human Rights in Strasbourg.

“Many have been harmed, but only some have been compensated. Surely, about ten of us who paid advances have been left without money and without apartments. The investor fled, and the property left behind him was looted,” says Kuridža.

“In 2008, ‘Del Invest’ offered for sale 176 apartments in a building that did not have a building permit and therefore could not be built with credit funds according to the law. But it was. Two years later, the owner of the company fled with the money. After numerous judgments, they were compensated from the sale of land on Veseli Brijeg (a neighbourhood in Banja Luka) at below-market prices, so there were not enough funds to compensate all claimants.”

Lawyer Miron Bjelovuk from Gradiška says that the demand for apartments is far greater than the supply, which often puts buyers in very unfavourable conditions.

They’re Not Buying Apartments, They’re Buying Hope

“Before the shovel hits the ground for the foundation, apartments yet to be built are sold out at a very high price. In such conditions, buyers are not cautious at all and agree to buy an apartment in a building under construction, which is being built on land burdened with a mortgage. Buyers of such apartments are often unaware of the risks they are taking and do not take notary warnings seriously,” says Bjelovuk.

According to the Real Rights Act, banks as loan providers have the right, if the loan is not repaid, to recover their claims from the apartments and business premises built on land mortgaged as collateral for the loan repayment.

“A change of ownership of the encumbered property is not relevant, and that is the principle of indivisibility. Simply put, you buy and fully pay the purchase price for an apartment built on land burdened with a mortgage, and then you wait for the bank as the mortgage creditor to initiate a judicial enforcement procedure by selling your apartment because the investor did not repay the loan taken earlier. So, as a buyer, besides participating in financing the investor’s business as a builder because, at the time of purchase, the apartment was not built, you are now also repaying the investor’s debts with which you have nothing to do except being impulsive and overlooking the notary’s warnings. Your hope that everything will be fine has not been fulfilled, but the investor was not put in a position to hope that you will somehow pay for the apartment,” says Bjelovuk.

He believes that it remains questionable whether it is fair to allow business operations under such unfavourable conditions for citizens as apartment buyers.

“Is there equal contribution when a buyer purchases and pays for an apartment yet to be built on land burdened with a mortgage? In my opinion, there is no equal contribution because the buyer pays the purchase price of the apartment by paying a certain amount of money to the investor, as the builder and seller of the apartment under construction. The investor knows exactly what he has received from the buyer as the purchase price. The monetary amount has an indisputable value, and the investor knows both the nominal and the utility value of it,” emphasizes our interlocutor.

On the other hand, he adds, the buyer does not know, or cannot be sure, what he can get in return for the money paid.

“In fact, the buyer is buying hope that he will buy an apartment and that everything will go smoothly. It is obvious that there is no equal contribution here,” says Bjelovuk, who believes that the legislator should regulate the business and activity of building and selling apartments so that this no longer happens.